Business Credit Card vs Corporate Credit Card

Travel perks are another common benefit, since many businesses have significant travel expenses. A business credit card might entitle the holder to use an airline’s VIP lounge at airports or receive discounts on hotel stays during business trips. Business borrowers can apply with or without an employer identification number (EIN), which makes it easier for small businesses to obtain a card. A global healthcare provider had been settling supplier payments electronically or by cheque, often up to 60 days after invoice approval. This created working capital challenges for a wide range of suppliers, from hospitals to hotels, whilst adding significantly to the company’s payment processing burden. The company, therefore, decided to work with HSBC to implement the bank’s Virtual Card solution with a view to improving suppliers’ experience of working with the company.

As the name implies, corporate credit cards are only available to S-Corporations, C-corporations, and some LLCs with an already established healthy credit history. Lenders generally expect a minimum spending threshold, and liability typically falls on the corporation instead of the business owner. This means that if the company goes under without having paid its bills, the business owner is not held responsible. Corporate credit cards and small-business credit cards are not one and the same. While corporate credit cards are designed for corporations with multiple employees and revenue in the millions, business credit cards are designed to meet small-business owners’ needs, including freelancers and side hustlers. Knowing which option is best for your business will help you apply for the right card — and having the right line of credit is a great way to help your business grow.

Employer Benefits of Using a Corporate Credit Card:

To access this coverage you must decline the Collision Damage Waiver (CDW/LDW) or similar coverage offered by the car rental company in its rental agreement. When you see this attempt to make an unauthorized purchase, you can tap or click the button to turn off Sally’s commercial debit card on your laptop or mobile device instantly. If you decide to end her employment, your ability to turn her card off means that you will not have to worry about retrieving the card from her. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

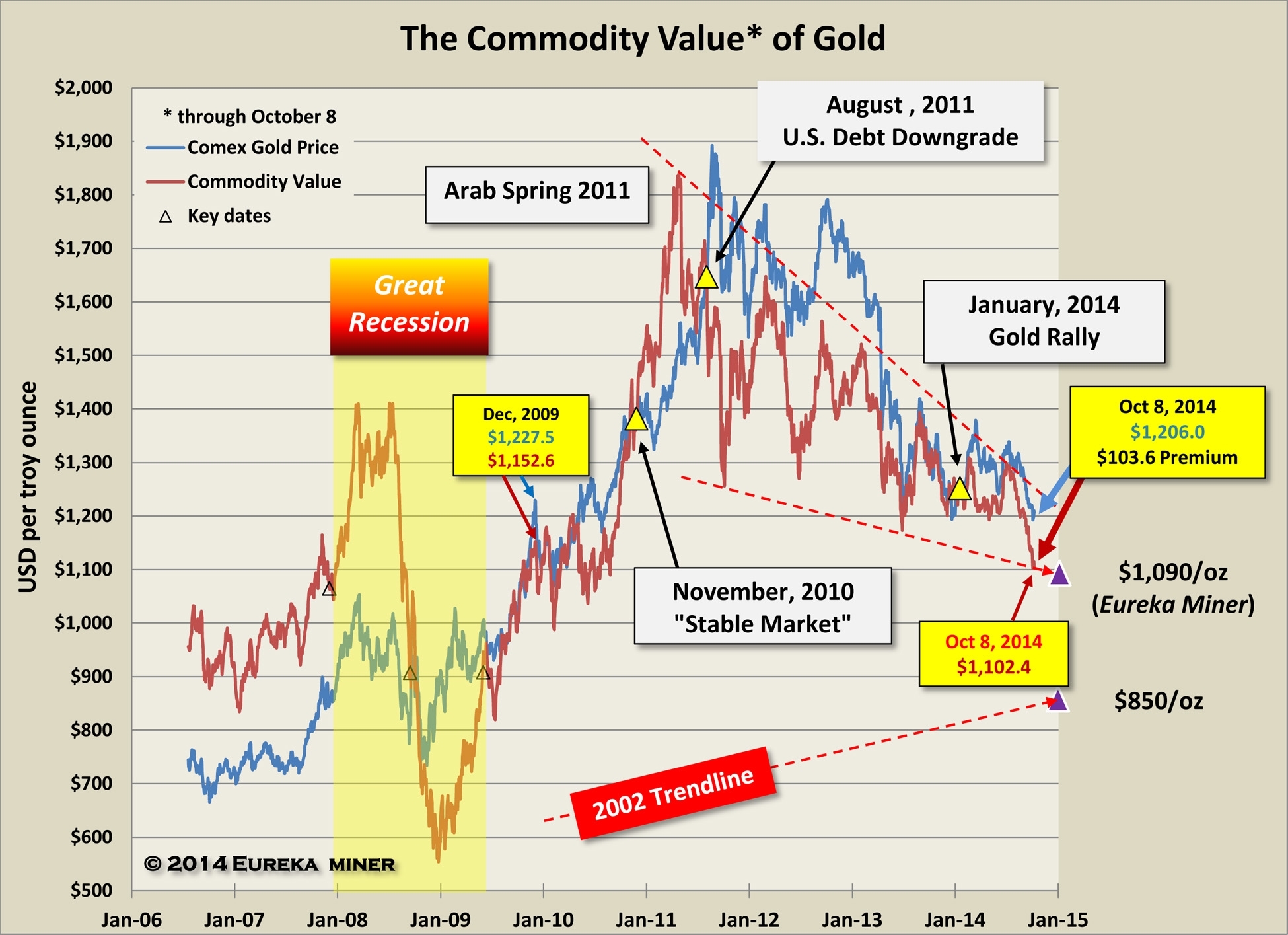

Fed Pauses Rate Hikes But Signals More Tightening To Come – Slashdot

Fed Pauses Rate Hikes But Signals More Tightening To Come.

Posted: Wed, 14 Jun 2023 18:12:00 GMT [source]

This enables employees to make purchases on behalf of the company without needing to use their personal cash or cards to make the transaction. Some card issuers have voluntarily extended some of those protections to their business credit cards, but applicants shouldn’t assume that unless it’s spelled out in the card agreement. Corporate Cards offer a standardised means of making supplier payments, and automatic enforcement of companies’ purchasing and operational controls, whether employees are based in centralised, subsidiary or homeworking locations.

Business card

Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs. Often this process is applied not only to business cards, corporate card meaning but also to letterheads, notepads, labels and compliments slips. Business cards can be mass-produced by a printshop or printed at home using business card software.

It’s also important to learn about any department- or position-specific rules. Company executives, for example, will likely have different spending profiles than, say, middle management. That means the employee must stay current on paying the bill in the short-term and request reimbursement by filing an expense report.

Open a multi-currency account built for .css-1hlskyycolor:#ff4f42;borderless business

A study by RPMG Research Corporation found that 65 per cent of employees working from home used cards issued by their organisations as the primary means of making business purchases7. Companies can use Corporate Cards to ensure that T&E and supplier expenses are incurred in line with corporate policy, with full visibility over expenditure helping to drive economies of scale with strategic suppliers. For employees, managing expenses is less onerous, and avoids the need to use personal cards for business expenses. Since they are sometimes more complex, corporate cards often come with their own designated customer service representative who can help resolve any issues quickly. These representatives are usually on-call 24/7 and have an intricate knowledge of each company’s individual needs.

In almost every corporate card program you can expect to pay an annual fee for using the service. Then, you’ll generally pay an extra annual fee per card issued to an employee. These fees vary wildly depending on the bank and the service and can be anywhere from $39 per card to almost $300 for a premium, rewards-driven corporate card service. As well as providing credit facilities to improve your business’ cash flow, corporate cards provide your business with a number of benefits. Corporate cards provide businesses with a way to monitor their spending more efficiently. They can be controlled to the degree that when set up properly, they’re only available to be used for certain types of purchases.